It’s hardly an exaggeration to say that the marketplace for modern art has changed dramatically over the past decade or so. Well-heeled collectors continue to spend billions of dollars on pieces both famous and obscure each and every year. Consequently, collectible art holds great financial promise for connoisseurs and casual fans alike. Understanding the current state of the art industry is imperative if you want to get the most out of your investments.

What the Art Market Looks Like Today

Today’s market for art is truly global in scope and remarkably fluid compared to the art market of yesteryear. Low interest rates and the accumulation of financial gains at the top of the economic pyramid have driven significant amounts of capital into the art world. Every year, nearly $60 billion worth of art changes hands through auctions and private sales between avid collectors.

While art sales are projected to remain healthy for the foreseeable future, the industry as a whole hasn’t grown appreciably since 2012. This stagnation is somewhat remarkable when you consider the doubling of the S&P 500 over the same time frame. The most serious potential threat to the value of modern art is a major geo-political crisis that roils equity markets. Such an event would divert capital away from tangible art towards less speculative investments.

A Quick Profile of Today's Art Collectors

At the moment, individual art collectors with comprehensive strategies for realizing gains on their investments are largely driving art sales. Art collectors are now the stars around which museums, dealers and private bankers gravitate. Once upon a time, gallery directors collected artists. Nowadays, they collect art collectors. Collectors play an important role as taste makers who influence the purchasing decisions of other enthusiasts, galleries and museums.

The most active players in the art game are relatively new collectors who operate in the real estate, hedge fund and private equity industries. These movers and shakers see art collections as a way to diversify their asset sheets. They tend to be quite savvy when it comes to maximizing returns on their art investments. Unlike more traditional collectors, they tend to buy and sell art with greater frequency as the prevailing economic conditions dictate.

Since the new breed of collectors are primarily focused on profit, their strategic approach to collecting is a net positive for the art community. That’s because they grasp the importance of carefully fostering art appreciation by patronizing artists and the institutions that support them. Many serve as trustees of local museums and galleries. More importantly, they collect non-commercial pieces and hesitate to flip works by trending artists simply because prices are rising in the short term.

2019 Auction Statistics Worth Knowing About

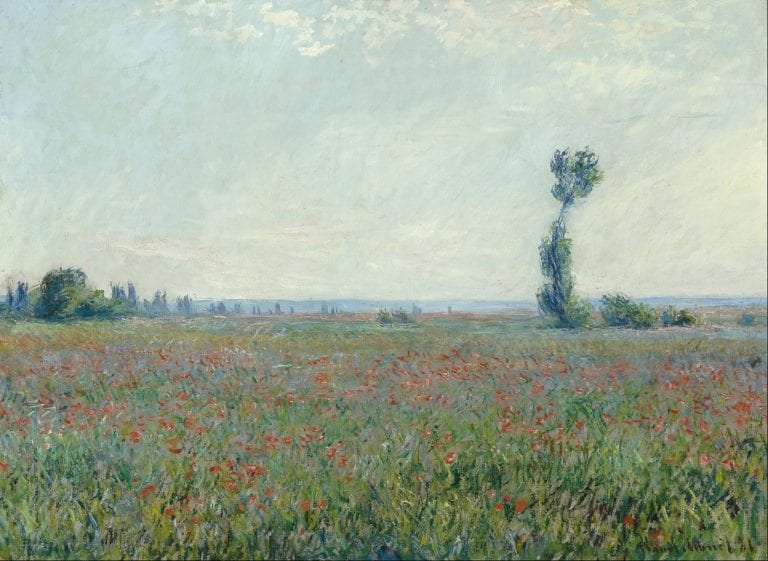

This year, the New York Spring Auctions at mainstays like Christie’s and Sotheby’s saw $2 billion worth of transactions. Notable purchases included a $91 million Koons Rabbit and a $110 million Monet Haystack. Repeat sales throughout the season accounted for an annualized return of 5.1%. Auction houses recorded profit margins of roughly 10%. Consequently, auction institutions are looking to diversify their revenue streams beyond mere commissions.

Auction Trends Around the World

Overall, New York continues to be the most lucrative market for high-end modern art. Concerns over the state of Brexit have had a noticeable impact on the sales volumes at London auctions. Thus far, Chinese auctions have failed to live up to optimistic growth expectations. While premiums are rising across the board, collectors can generally expect to pay higher commissions for lower value works at any auction.

One of the biggest stories in the auction world is the increasing use of fairs to drive sales. This year’s Art Basel fairs were the most profitable shows in the history of the venerable institution. Nearly 50% of annual sales at major galleries now occur during art fairs. At present, there are more than 300 fairs held annually across the globe. The Frieze Art Fair even expanded into the Los Angeles market this past January.

The Growth of Technology in the Art Market

In many ways, modern art is one of the few industries that remains largely untouched by technological disruption. Though most sales continue to take place in person, online art transactions are growing at a steady pace. Online marketplaces like LiveAuctioneers are receiving increasing attention from venture capitalists. Furthermore, Christie’s became the first auction house to record transactions using a blockchain-backed digital registry.

When it comes to marketing, collectors are increasingly relying on Instagram to generate enthusiasm for pieces that they’ve invested in. Likewise, dealers and auction houses are using the wildly popular photo-sharing app to advertise their brands to a younger clientele. Experts predict that Instagram-based marketing will lead to price volatility for works by select artists on the rise. Furthermore, analysts expect Netflix-style recommendation engines to become more and more commonplace in the digital art marketplace moving forward.

The Long-Term Investment Outlook

Provided that there is no market crash, all in all, art lovers can expect to see a fairly stable market in the coming years due to a variety of factors. The growing participation of financially savvy collectors should lead to moderate price appreciation for works by established artists. That having been said, investing in art is an inherently risky endeavor. As such, buyers shouldn’t view their purchases solely as investments vehicles.

The South Florida Art Market: It's Where You Want to Be

To have a better vision of what happened to the local market, we spoke with Christopher Georgopoulos, a Private Client Advisor for Bank of America Private Bank that covers the Palm Beaches. He quoted, “There is probably not a better market in the country. In addition to the already vibrant cultural presence in the area, our area continues to experience a large migration of residence from the higher-taxed Northeast. Bringing not only their wealth to the Palm Beaches, but their passions for the Arts. More specifically from a business perspective, the lower interest rate environment has increased the demand for loans on art collections and our consignment services have grown as the younger generation have a tendency to “not want Mom & Dad’s collection.” But the most demanded service in the area is planning for an art collection. It’s amazing, but so many collectors overlook their art within their estate planning. Which can cause countless problems upon execution of the estate.”

This concise assessment of the local art market in South Florida only reinforces what Bank of America’s analysts forecast for the broader market in 2019 and beyond. Long story short, it’s a great time for South Florida residents to invest in post-war and contemporary art. The upside potential of today’s art market is certainly enticing. The fluid nature of the marketplace allows investors to quickly secure stunning works while giving them the flexibility to modify their collections when necessary. For art lovers and investors alike, it’s a win-win opportunity that doesn’t present itself very often.